HELP DESK

What are your branch hours?

Most Family Security branches are open Monday through Friday. Some branches are full service on Saturdays, while others only service the drive-thru. Please view a complete listing of our branches for operating hours.

How can I become a member?

Membership is available to individuals and businesses that live, work, worship, or attend school in the counties we serve throughout Alabama.

Click here to open an account.

How can I change my address/name on my account?

To change your address call us at 1-800-239-5515 and a representative will assist you with the address change, or you may visit one of our convenient locations and a representative will be happy to personally assist you.

To change the name on your account, you must provide the proper ID in person for a representative to make the changes to your account. Proper IDs include State-issued driver’s license, State-issued non-driver’s license, US Passport, Military ID, Voter ID card, or Permanent Resident card.

How can I dispute a charge on my debit card or credit card?

For a debit card, a Card Dispute Form must be completed with documentation to support the dispute, and returned to your local branch for processing, or you may fax the form to 256-340-2024.

For credit card disputes, you may call us at 1-800-239-5515, and a representative will assist you, or you may login to FSCU@HOME, access you credit card account, then complete and submit the Credit Card Dispute Form.

How do I set up Direct Deposit?

Don't wait in line to deposit your paycheck. Direct deposit is the safe, convenient way to deposit your check on payday and is available from most employers.

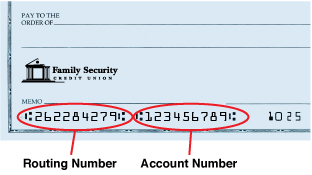

To participate in Direct Deposit, your employer will need Family Security's Transit Routing number, 262284279, and your account number. Both sequences of numbers are located at the bottom of your personal checks. The first sequence of numbers on the bottom of the check is the Transit Routing number and the second sequence of numbers is the account number (See Diagram Below). Most employers require a copy of a voided personal check to begin the process.

Do you offer notary services and which branches offer those services?

Each Family Security branch has a Notary on staff. Medallion Stamps are also available to members who may need that service. Branch locations that provide Medallion service are Decatur-Main, Guntersville, Hartselle, and Mobile-Airport Blvd.

How do I wire funds to my Family Security account?

To Wire funds to Family Security Credit Union, give your financial institution the following wire transfer instructions. These instructions are for wire transfers only and are not to be used for ACH payment, direct deposit or other electronic payments:

- To: Corporate America Credit Union, Birmingham, AL ABA # 262090120

- For further credit to: Family Security Credit Union, ABA # 262284279

- For final credit to: (add member’s name, FSCU account number here)

There is no fee for incoming wires.

How do I wire funds to another financial institution?

To Wire Funds To Another Financial Institution from your Family Security Account, visit a branch to complete a Wire Transfer Agreement form.

View Fee Schedule for domestic and international wire transfers.

How do I add someone to my account?

All parties to be on the account must visit a branch and bring a government issued ID to be verified, and new signature cards must be signed.

How do I open a business account?

Family Security offers business accounts for several business types. Each business type has specific requirements to open an account. Please call us at 1-800-239-5515 for more information.

How do I apply for a loan?

If you are currently a Family Security member, you may apply for a loan online through FSCU@HOME or by visiting your local branch. A government issued photo ID is required, and in some cases proof of income may be required.

View Fee Schedule for fee associated with applying for a loan.

How many ATMs does Family Security have?

Please view a complete listing of our branches for locations with ATMs.

Family Security is also a part of the MoneyPass ATM Network, which provides members with an expanded surcharge-free cash access at nearly 30,000 ATM locations. These ATMs are in convenient retail locations. Check out the MoneyPass ATM Locator or download the mobile app to find a location near you.

How can I get a copy of a check?

To obtain a copy of a check, several options are available. You may login to FSCU@HOME, select Check Options and Request Copy of a Check, then submit the draft number you wish to receive. At this point, you will be contacted by a Credit Union representative regarding your request.

Other options for Check Copy Requests include visiting a branch or you may call us at (256)340-2000 or (800)239-5515.

View Fee Schedule for check copies.